Billionaire count: 57Total wealth: $125 billionKnown as the playground of the rich and famous, Switzerland is 8th in the global billionaire sweepstakes and ranks 7th as the home of those worth $30 million and more, or the ultra-wealthy.Switzerland’s billionaires represent the top one percent of its 5,597 ultra-wealthy population and control more than 19 percent of the total fortune of this group. On average, these billionaires are worth $2.2 billion each.Despite Europe as a whole seeing a declin

Photo: Ingolf Pompe | LOOK-foto

Switzerland has long been a haven for the ultra-rich. Its 300 wealthiest residents are worth a combined 850 billion Swiss Francs, or just over $1 trillion, according to business magazine Bilanz.

So it was perhaps unsurprising that a new inheritance tax was resoundingly rejected by voters on Sunday.

The proposal to tax every inheritance and gift of more than 50 million Swiss Francs at 50% was defeated with 78% voting against it.

Powerful Swiss business lobby Economiesuisse called talk of the inheritance tax a “superfluous and damaging discussion.”

It welcomed the proposal’s defeat, saying: “The threat of forced sales of companies and the resulting weakening of the business location have convinced those entitled to vote from all political camps.”

The proposal came from the youth wing of the country’s left-wing Social Democrats. Money raised from the tax would have been earmarked to fund policies to combat climate change, with the party saying it would “channel billions into climate protection every year while simultaneously combating extreme wealth inequality.”

‘The ultra wealthy are like queens on a chessboard’

Before the vote, close followers of the debate told CNBC the initiative, first proposed in 2024, had already shaken wealthy individuals and family-owned companies.

Swiss billionaire Peter Spuhler, founder and owner of Stadler Rail, had threatened to leave the country if the tax became law. He told Swiss daily Tagesanzeiger that his family would struggle to pay such a tax as their wealth is tied up in companies.

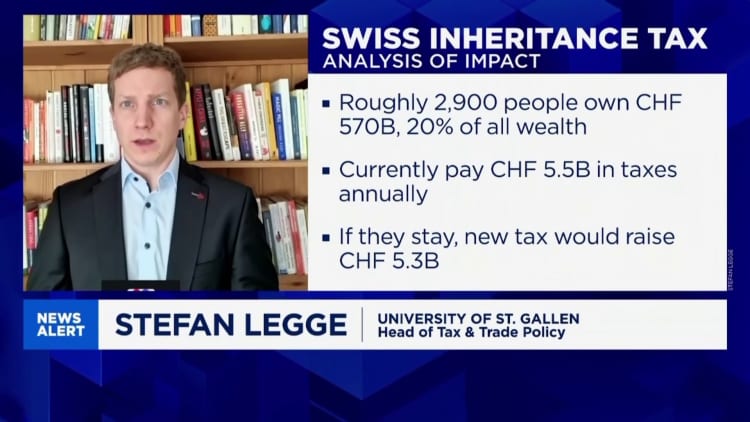

“A lot of people who would be affected talked to their consultants and their tax lawyers, and they did the paperwork to be sure that this time of the year, a week before the final vote, they are ready to move out if necessary,” Stefan Legge, from the University of St. Gallen in Switzerland told CNBC on Friday.

Legge, who conducted research into the potential impact of the tax, said: “If you target the super wealthy, they are like queens on a chessboard.”

“They are very mobile. They have tons of options to optimize their taxes,” he added.

Kurt Moosmann, president of the Swiss Single Family Office Association, told CNBC the proposal had caused “a certain uncertainty among family offices and has kept foreign capital holders away from Switzerland.”

One potential impact of the 50% tax, if implemented, would have been a fall in tax revenue, according to Legge. He said that around 2,000 people, or 0.3% of Switzerland’s population, would be affected and they currently pay between 5 and 6 billion Swiss Francs a year.

But although Switzerland faces competition from wealth centers in the Middle East and other countries in Europe, Legge said Switzerland was “still very strong” on “finding the right balance between taxes and the right public services.”

Giorgio Pradelli, CEO of Swiss private bank EFG International, agreed that Switzerland remains in a strong position.

“If you look at the overall competitive landscape, Switzerland remains the No. 1 destination for international private banking and wealth management,” he told CNBC last week. “We have an ecosystem that is super healthy and strong.”