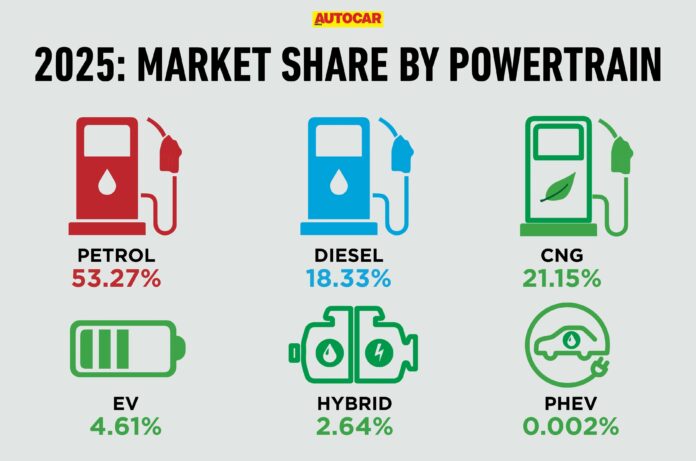

Petrol is the only powertrain type to lose market share in 2025, dropping from 59.4 percent to 53.3 percent, even as overall passenger vehicle sales rose to 45.8 lakh units (estimated), about 6 percent higher than the previous year. CNG, EVs, diesel and hybrids all gain ground, suggesting buyers are looking beyond petrol for lower running costs.

Market share by fuel type

| Fuel Type | 2024 | 2025 |

| Petrol | 59.44% | 53.27% |

| Diesel | 17.93% | 18.33% |

| CNG | 17.76% | 21.15% |

| EV | 2.55% | 4.61% |

| Hybrid | 2.32% | 2.64% |

| PHEV | 0.003% | 0.002% |

Petrol share slips as buyers weigh running costs

E20 petrol rollout raises efficiency concerns among buyers

Petrol remains the most common fuel type in India, but its market share has declined with more buyers considering alternatives. In absolute terms, about 1.3 lakh fewer petrol cars were sold compared to 2024. The wider rollout of E20 petrol has also led to slightly lower real-world efficiency, prompting some buyers to look at other fuel types more closely.

Diesel demand remains stable

SUVs keep diesel relevant in 2025

Despite concerns over long-term viability, the market share of diesel cars has edged up to 18.3 percent in 2025, supported mainly by demand for SUVs. While many brands have reduced diesel options in smaller cars, the fuel type remains common in midsize and ladder-frame SUVs, helping keep the demand stable.

Mahindra’s diesel SUVs – Thar, Scorpio N, Bolero and the XUV range – remain key sellers in their respective segments, along with diesel offerings from Toyota, Hyundai and Tata. This consistent demand for diesel SUVs has also helped Mahindra seal the second spot in 2025 car sales as buyers continue to choose diesel in larger vehicles.

CNG posts strong growth

Lower running costs drive urban demand

CNG models have seen a big jump, up from 17.8 percent to 21.2 percent, supported by factory-fitted CNG options across entry-level models, especially from Maruti Suzuki and Tata, giving buyers familiar cars with lower running costs.

Once seen mainly as a budget alternative, CNG is now a mainstream choice for regular city use thanks to wider availability and predictable fuel costs.

EVs’ share nearly doubles

But charging access still limits wider uptake

EVs accounted for 4.6 percent of the cars sold in 2025, nearly doubling their share from 2.6 percent in the previous year, though overall volumes remain limited. Growth is supported by new launches offering improved real-world range, with EVs accounting for over 40 percent of all new models introduced in 2025.

Charging access outside major cities still slows wider adoption, but EVs have shown the fastest rate of increase among all powertrains, reflecting strong demand in areas with adequate charging access.